Being a successful freelancer or contractor doesn't just take insight, confidence, and bags of creativity. You also need to be on track with your finances – not doing so can be perilous, since earning from job to job requires a steady income stream, knowing your expertise is duly valued throughout the year.

Hence the following money management tips, presented to give you the best chance of staying on the ball with your accounts. Take heed of this advice, and grasp your financial status with both hands…

Assess your outgoings

Whether you're working from home, sharing an office space, or constantly on the move, there are a couple of costs that you're likely to deal with. They can encompass anything from line rental charges to petrol top-ups as you drive between meetings, and they can accumulate viciously if they burn through your funds at random.

To get a real overview of your outgoings, monitor your spending in a week, and then a month, to see if there's a pattern. By building a picture of your expenses, you can ensure you price your services at a level that covers your outgoings, while leaving ample funds for tax and take home pay.

Make sure your pricing is clear

People aren't always great communicators. Or, if we try to be, a lot of that clarity depends on our method of discussion, as opposed to what we're trying to say. Clients can easily lose track of costs; if you speak via email, or over the phone, there are many opportunities to be misconstrued.

Document your rates clearly and share them upfront. Whether you work hourly or per project, having a written record of what you charge – and what's included – prevents the awkward conversations that arise when expectations don't match.

Know your real-time value

As assignments fly at you thick and fast, you'd be forgiven for letting a true portrait of your earnings fall apart. It's hard to master your accounts at the best of times, and when you're swamped with fresh deadlines, chasing invoices when you can, your cash flow can be hard to decode.

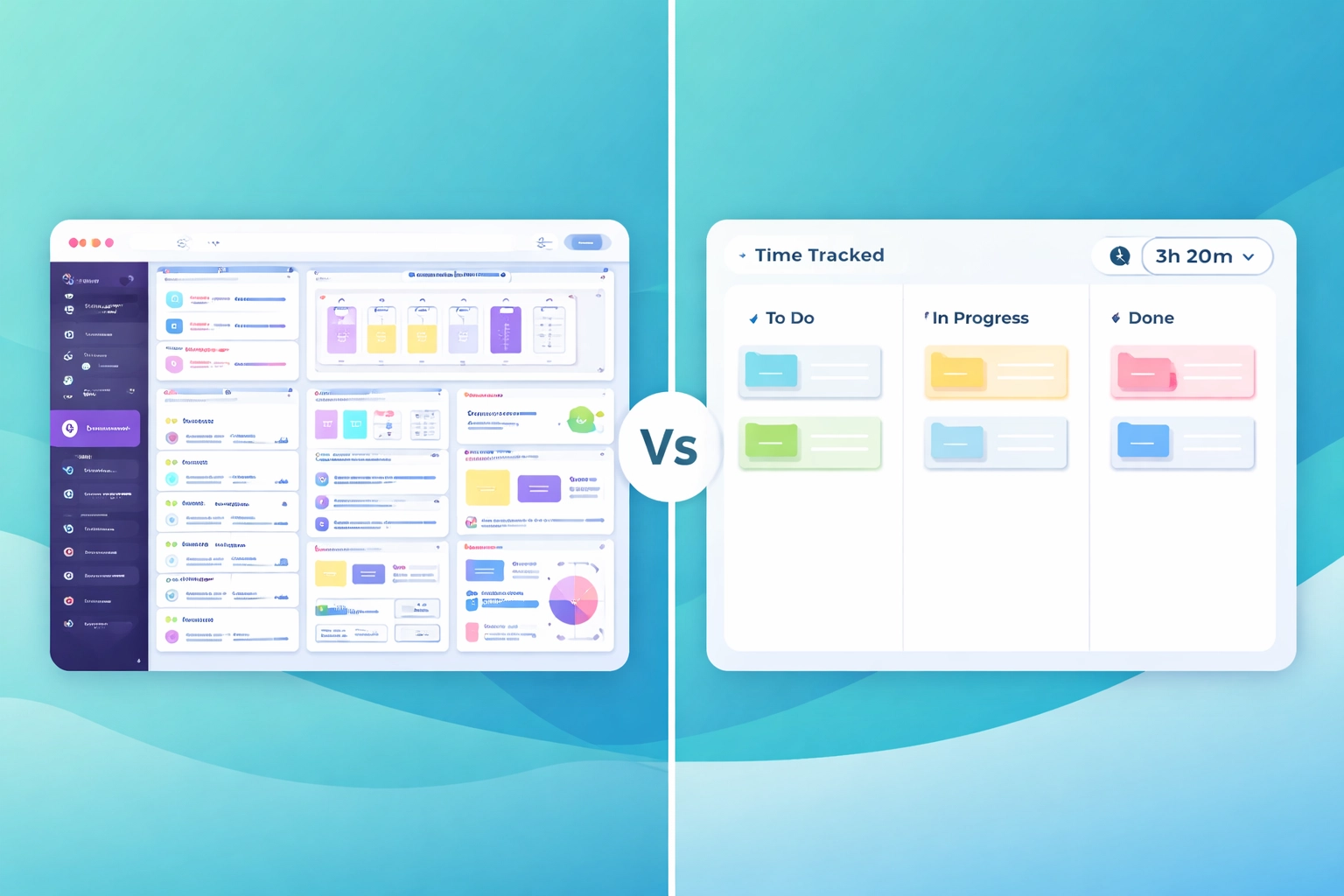

This is where time tracking becomes invaluable. Tools like Task Board have built-in time tracking that logs hours against specific tasks and projects. You can see exactly how long each piece of work takes, which helps you price accurately and identify which clients or projects are most profitable.

If you allow a hazy financial perception to grow, it'll swallow your sense of order, making invoicing and tax submissions extremely troublesome. Track your time, know your numbers, and reap the benefits of a steadier income as you climb in stature.